There are 3 important factors that you need to find breakout signals to buy with high probability of making a profit on a trade.

3 Important Factors

- You must know when the breakout occurs.

- You must know the direction and strength of the trend.

- You must have a higher than average volume.

BREAKOUTS

Breakouts occur when the short term trend changes to:

- Bright Green for a Buy Signal

- Bright Red for a Sell Signal

You can have a Breakout from:

- a pullback or retracement from the trend

- a breakout from a consolidation

- a breakout from a reversal of the previous trend

DIRECTION AND STRENGTH OF THE TREND

Breakouts for the strongest Buy Signals,come from these setups in this order of potential.

- Trends with long term Bright Green and short term Bright Green

- Trends with long term Dark Green and short term Bright Green

- Trends with long term Dark Red and short term Bright Green

- Trends with long term Bright Red and short term Bright Green

VOLUME

Different Breakouts come with different increases in Volume

- Breakouts with low volume are usually false breakouts.

- Breakouts with higher than 50 day average volume increase the possibility of a profitable trade.

- Breakouts with volume percent set at higher than 100% are the best setups.

- Breakout with higher than 150 volume percent are usually from an event of news

- Select the Detailed Quote to find the news on that particular security.

IMAGES BELOW THAT DEMONSTRATE THESE SETUPS.

Setup Screen

(click on image to enlarge)

Buy Signals

(click on image to enlarge)

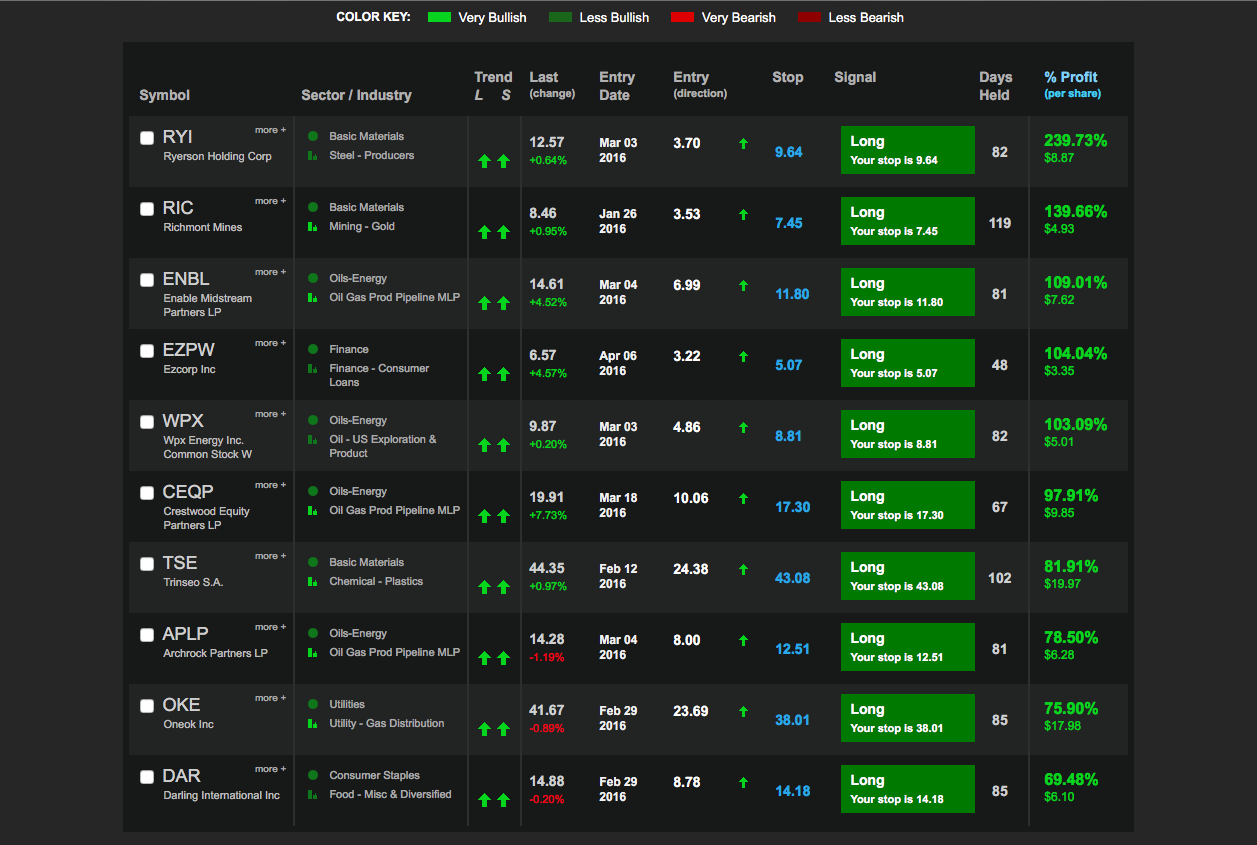

With Strong Trends you get these kind of Results

(click on image to enlarge)

These same setups work for Sell Signals as well.